Health Plan Costs for 2021 Will Rise by 5.3%

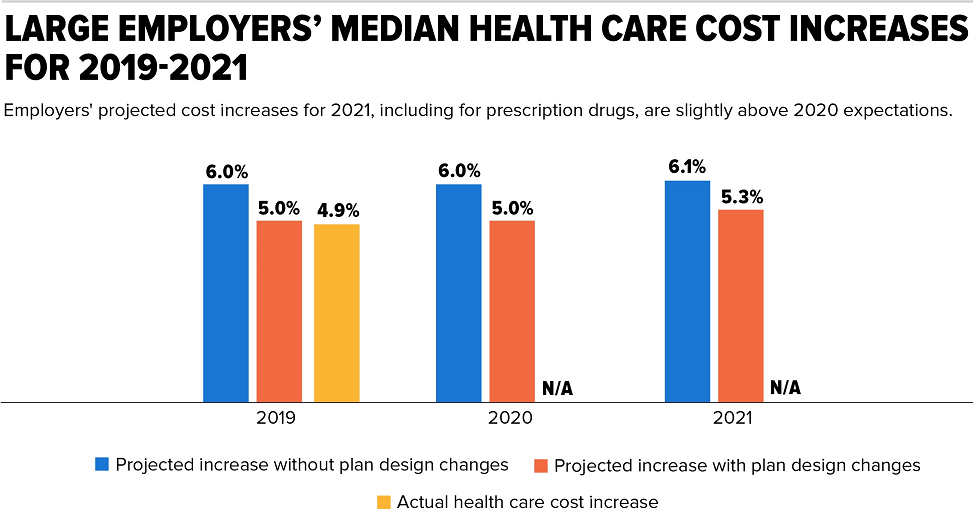

According to giant hiring managers, their health plan costs for 2021 will escalate 5.3 percent, even though the COVID-19 pandemic is adding doubt to the overall cost, as shown by the survey of large employers in the U.S.

The foreseen rise in health plan costs for 2021, which considers employers’ health plan cost-management, is somewhat more than the 5 percent builds huge employers projected in every one of the most recent five years, as per recently delivered outcomes from a yearly review by the not-for-profit Business Group on Health (BGH), which speaks for enormous employers.

The group conducted its 2021 Large Employers’ Health Strategy and Plan Design Survey in May-June 2020. It thus collected feedback in the form of responses from 122 huge employers who gave the plan to more than 9 million workforce, and their dependents. Point to be focused on here is that each respondent out of the 77% had employees of more 10,000 people.

Employer and Employee Costs

Average total health expenditure comprising of premiums and out-of-pocket costs of the employees is projected to reach $14,769 per employee during the current year, which is $197 higher than that in 2019. Total costs are expected to increase to an average of just over $15,500 by the year 2021.

Furthermore, the survey also highlighted that parallel with recent years, large employers will cover around 70% of expenses while employees share of burden is near 30%:

◙ For 2020, that makes employers pay about $10,340 per covered dependent or employer, with employees’ payment burden of about $4,430.

◙ For 2021, those amounts will expectedly rise to about $4,650 and $10,850, respectively.

“Health care costs are a moving target and one that employers continue to keep a close eye on,” told Ellen Kelsay, BGH’s president and CEO. “The pandemic has triggered delays in both preventive and elective care, which could mean the projected [cost] trend for this year may turn out to be too high. If care returns to normal levels in 2021, the projected trend for next year may prove to be too low. It’s difficult to know where cost increases will land,” where employers will need to be lenient and more compromising with health care budget revisions during the next year.

Virtual Care Growth

It is for sure that use of telehealth services increased steeply during the coronavirus pandemic. “While employers have been implementing more virtual solutions in recent years, the pandemic caused the pace to accelerate at an astronomical rate,” Kelsay added.

76% of the respondents did modifications for a better and easier access to telehealth services. 71% of them increased the number of telehealth offers, like adding emotional well-being support and health coaching.

Out of the total respondents, 80% think virtual health will acquire a central role in the procedure of how care is extended and delivered in future.

Among other telehealth trends, the survey pointed out:

◙ More than half of respondents (52 percent) will offer more virtual care options next year.

◙ While 91 percent will offer telemental health (online counseling or therapy), 96 percent said they will offer telemental health services by 2023.

◙ Virtual care for musculoskeletal issues, such as physical therapy for back and joint pain, shows the greatest potential for growth. While 29 percent will offer musculoskeletal management virtually next year, another 39 percent are considering adding it by 2023.

◙ Nearly all will offer telehealth services for minor, acute services.

Mental Health and Well-Being

Another central pattern for employer plans in 2021 is the development of admittance to virtual psychological well-being and emotional well-being services, which can lessen the stigma associated with seeking care.

Above 69% of respondents give access to online mental health support resources, like videos, apps, and articles, and that projected increase in number is upto 88 percent in 2021.

Employers are also taking positive measures to strengthen mental health services:

◙ Half of respondents (50 percent) will conduct campaigns against stigmatizing those dealing with mental health challenges in 2021.

◙ Roughly half (47 percent) provide manager training on recognizing mental and behavioral health issues and directing employees to services. Another 18 percent plan to do so in 2021.

Big employers also facilitate to overcome cost hazards by minimizing out-of-pocket costs for mental health services:

◙ More than a quarter (27 percent) will reduce the cost of counseling services at the worksite, bolstering the trend of bringing services directly to employees.

◙ More than half (54 percent) are lowering or waiving costs for virtual mental health services in 2021.

“Employers were already prioritizing mental health and emotional well-being before the pandemic hit,” Kelsay told. “Many more employees and family members are now dealing with anxiety, stress or loneliness. We expect employers will boost their investment in programs that support employees’ mental health and emotional well-being.”

New Approaches

Employers also are planning wisely and more logically about health care, considering actions such as the following:

◙ Linking health care with workforce strategy. The number of employers that see their health care strategy as an essential component of their workforce strategy increased to 45 percent this year from 36 percent in 2019.

◙ Addressing high-cost drug therapies. 67% of the respondents referred to the effect of new million-dollar treatments as their top pharmacy benefits management concern.

◙ Focusing on primary care. 51 percent of the respondents liked to have at least one advanced primary care strategy next year, up from 46 percent in 2020. Voters of these arrangements say that to contract directly with primary care providers may enhance the delivery of precautionary services, mental health, chronic disease management, and the whole-person care.

If you want to know more about the Health insurance premiums in 2021 insurance quotes, or , instant auto insurance quote, farmer insurance, and what is the process an procedure of purchasing health insurance particularly GEICO insurance quotes, please keep reading further articles.

#Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021 #Health Plan Costs for 2021

Relevant Post

Top 5 Trends in the Insurance Industry

When You Might Need Private Insurance

Private Health Insurance in USA

The Top 10 Business Writing Skills to Learn Today

What Can You Do With an English Literature Degree?

Top 7 Workplace Safety Hazards in the USA

18 states in coronavirus red zone should roll back reopening

UN warns of falling vaccination levels due to COVID 19

Princess Beatrice marries in secret ceremony in front of Queen